Retail investors are deluged with options when it comes to buying into the market. With low or no fee options available across stock trading platforms these days, it can be a hard sell to convince new clients to stick with your advisory services. But stock brokers and advisors have a leg up on the competition among individual investors. When it comes to trading expertise and available asset classes within and outside the limits of the stock market for creating and growing wealth, DIY investors are simply outmatched. Sticking with a stock trading advisor is often where the smart money lies, but convincing your clients that your services give them an advantage over going it alone isn’t always that simple.

There are three primary areas in which stock brokers shine, and retail investments simply can’t keep up. Highlighting the benefits of an advisory service through these three pillars is the best way to grow your brokerage business and continue to provide rock solid investment advice to loyal clients.

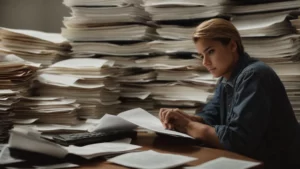

1. Professional advisors have the best expertise.

Professional stock traders are the experts in technical analysis, following the beat on the street and jumping on fast movers as soon as they hint at a growth opportunity. This is most often seen in the stock market, but pros are equally skilled at locking in profits in real estate and alternative investing opportunities with low correlation to the stock market as well. Creating and growing equity in a portfolio of diverse asset classes is what an investment advisor lives for, and the results speak for themselves.

Your brand comes prepackaged with this level of expertise—you are supposed to know more and be faster than the average retail investor. Selling yourself on this point is the first pillar of your brand. Your knowledge base is the key to building your business. As a professional, accredited investor, your day job is the acquisition of financial and business knowledge in order to make the most of investment opportunities across a spectrum of asset classes or sectors in the stock market. Pros have greater access to alternative investments simply through their depth of knowledge. Utilizing platforms that facilitate these buys is often a great way to create additional returns, but with a minimum investment threshold higher that the average DIY investor, professionals can leverage their portfolios to engage with an amazing variety of information sources and asset classes. For more on alternative investment ideas read a few Yieldstreet reviews to learn what this investment platform can offer your own portfolio of alternative investments and diverse asset classes.

There is a reason why the most successful investors in the world spend so much time reading, and it’s a fact that can really benefit your business. The average investor just doesn’t have the free time to spend learning and growing their trading chops at the level that you and your competitors have. The ability to dazzle clients and prospective partners with statistical analysis and new trading ideas based on your research is something that you should wield prominently in order to attract new money into your business.

2. Professional stock market traders can create loyalty with powerful credentials.

Becoming an accredited advisor or fiduciary is a great way to expand upon this sales pitch. A fiduciary, in particular, is legally bound to act in the best interest of his or her clients, whereas a run of the mill investment advisor must do due diligence and find individual stocks or ETFs—like the Canadian Couch Potato ETF—that make sense to purchase, but doesn’t have to pass along advice that best serves the client. Certainly, most investment advisors act in their clients’ best interests, but the added layer of protection that a fiduciary duty conveys can be a powerful selling point when approaching new clients.

The trust that these accreditations convey are a powerful tool for expanding your brand and business. The average investor lacks your depth of knowledge, but without these credentials they may not find it easy to trust your forthcoming use of that knowledge base – rendering it useless. By becoming a fiduciary you can feature this professional standard of trust as a major selling point when attracting new clients. With this, you can be trusted to both possess highly technical trading skills, and utilize them in the best interest of your clients. This is the foundation of a strong and long lasting partnership between and advisor and his or her clients.

3. Professionals offer an unmatched business service.

As a professional stock trader, you run a business that gives individual investors access to new and powerful tools that they would be excluded from otherwise. This begins with access to a professional office space. Rather than combing through stock and real estate investment opportunities on their cell phone, investors can walk into your office and feel the full weight of a professional trading outfit. With water delivery services, a team of investment advisors, and cutting edge trading software and technical analysis decks, like the Bloomberg Terminal, your clients know that they are walking into the big leagues. Water services are often a great touch that can really provide your clients with the professionalism that we have come to expect from an office of really any industry. These smaller details are critical to creating the bond of trust that you need in order to connect with long term clients.

In your office, clients can speak freely about their hopes and desires for the portfolio, and the professional setting merged with your expert advice can often provide the perfect backdrop for creating a long term investment plan for your clients. Each individual investor is different, and needs a unique blend of investment opportunities. Some require bonds, mutual funds, and index funds as the primary thrust of their holdings. This is a typical mixture for older adults who are looking to continue growing their savings but need to defend the principal cash that they have already created. Others are looking for an aggressive stance that leans heavily on startups or fast movers in order to build new wealth. This is more typical of a younger investor, but may be right for others as well. Your advice will weigh heavily on the decisions made by your clients, so an office that is designed specifically for these decisions is crucial to your success.

Professional investment advisors offer an unparalleled service that can’t be replicated by individual investors. Show off your expertise in order to continue building your client list.