An important decision you need to make when preparing to open a new restaurant is whether to lease or buy restaurant equipment. Leasing commercial restaurant equipment is a great way to save a lot of money. The appliances in a commercial kitchen endure more wear and tear than appliances in a home kitchen. They also have more costly repairs and longer downtime. Leasing pieces of equipment come with better and longer warranties than buying.

Lease the right commercial equipment.

You don’t have to lease all pieces of equipment. It’s a good idea to lease restaurant equipment that has a short lifespan. This includes ice machines, dishwashers, coffeemakers, and coolers. It’s also a good idea to lease items that get dirty quickly, such as table linens, uniforms, floor mats, and dishrags.

Leasing commercial kitchen equipment saves you a lot of money compared to purchasing. Equipment finance allows you to make affordable monthly payments while you use the restaurant equipment. Having the right kitchen equipment generates positive cash flow and the ability to keep up with new business startup opportunities. The Restaurant Warehouse offers restaurant owners flexible financing solutions and monthly payment terms when they lease restaurant equipment. Leasing without the need to make a down payment or collateral is the best option for preserving working capital and your credit score. You can find all the essential commercial equipment your restaurant needs to succeed, including freezers, refrigerators, prep tables, and more.

There are a few things to consider before leasing.

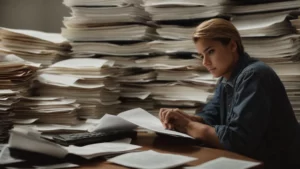

Leasing equipment means making monthly payments and signing a contract. Should your restaurant close before the lease ends, you may be liable for making the remaining payments for the term of the lease. The kinds of equipment your commercial kitchen requires depend on the layout. Restaurant kitchens are often small, so it’s necessary to utilize every inch of space.

One of the perks of not owning kitchen equipment is not having to deal with common problems that result in costly repairs. Calling an appliance repair service when your refrigerator breaks down costs a lot of money. The good news is that you don’t need extensive experience to do DIY appliance repair. With the help of a refrigerator repair technician, you can easily tackle refrigerator repair for a fraction of the cost of home appliance repair services.

Virtual Appliance Repair offers virtual refrigerator repair services over the phone or via video app, helping you save time and money. Simply schedule service online and you’ll be paired with a technician who will walk you through each step of the repair process. Their factory-trained and certified technicians can help you repair any model of kitchen or laundry appliance from brands such as GE, Maytag, Viking, Whirlpool, and LG. They can help with refrigerator repair, washer and dryer repair, stoves and ranges, ovens, freezer repair, ice maker repair, and more.

What are the benefits of leasing?

Leasing large commercial equipment is a great way to save start-up capital for other aspects of your new business. It’s a better use of working capital to lease pieces of equipment and apply your savings toward food orders, payroll, marketing, or other expenses. It’s possible that if you have already purchased equipment from a company that they will lease a piece of equipment for free. Leasing helps you avoid the cost and hassle of making appliance repairs when equipment breaks down. It’s easier to upgrade to a better or newer model when your lease runs out if you decide to renew.

A startup restaurant doesn’t have any established credit, which means you’ll have to use personal credit to qualify for a lease. If you have poor credit, you may need a cosigner. Always pay attention to the lease terms and the length of the contract before signing.