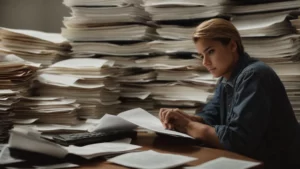

With the rising costs of car insurance, it can be difficult to keep up with payments without breaking the bank. But there are car insurance discounts available that can help you save money on your premiums. From multi-car discounts to discounts for safety features, there are plenty of ways to lower your car insurance payments. Keep reading to learn about car insurance discounts you should take advantage of, and be sure to check out https://www.iselect.com.au/car-insurance/ to compare the best car insurance deals.

The Safe Driver Discount

The Safe Driver Discount is a car insurance discount that can save you money on your insurance premiums. This discount is typically offered to drivers who have a clean driving record, which means no accidents or traffic violations. Insurance companies offer this discount to encourage safe driving and reduce the risk of accidents on the road. By taking advantage of this discount, you can not only save money but also promote safe driving habits and reduce your risk of accidents.

To qualify for the Safe Driver Discount, you must have a clean driving record for a specified period, usually three to five years, depending on the insurance company. You may also need to take a defensive driving course to prove that you are a safe driver. This discount can vary depending on your insurance provider, but it can typically range from 10 to 20 percent of your insurance premium. Be sure to check with your insurance company to see if you qualify for this discount and how much money you could save.

The Multi-Policy Discount

If you have multiple insurance policies with the same insurance provider, you may be eligible for a Multi-Policy Discount on your car insurance. This discount is designed to reward customers for their loyalty by providing a discount on their car insurance premiums when they also have other types of insurance, such as home or renters insurance, with the same provider.

The Multi-Policy Discount is a great way to save money on your car insurance premiums while also ensuring that all of your insurance policies are with the same provider. By consolidating your insurance policies, you can simplify your billing and management, making it easier to keep track of your coverage and ensure that you have the protection you need.

The Good Student Discount

Car insurance can be a significant expense, especially for young drivers who may have higher premiums due to their lack of driving experience. One way to save on car insurance is to take advantage of the Good Student Discount. This discount is available to students who maintain good grades in school, typically a grade point average of 3.0 or higher. The rationale behind this discount is that students who maintain good grades are generally responsible and less likely to be involved in accidents. By taking advantage of this discount, young drivers can save up to 25% on their car insurance premiums, making it an excellent option for families on a tight budget.

The Low Mileage Discount

The Low Mileage Discount is a car insurance discount that rewards drivers who drive less or have lower mileage consumption. Insurance companies typically offer this discount to drivers who travel fewer miles each year than the average driver. The rationale behind this discount is that drivers who spend less time on the road are less likely to be involved in accidents, making them a lower risk for insurers. If you are someone who drives infrequently or primarily uses public transportation, you may be eligible for this discount.

Overall, car insurance discounts can help you save money and reduce your premium costs over time. Taking advantage of these discounts can help you get the coverage you need at the best possible price. It is important to review the available discounts to ensure you are taking advantage of all the ways you can save.