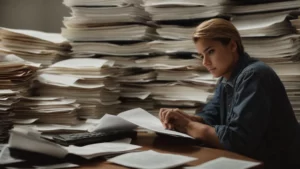

Students often learn about the importance of financial aid in a hurry. Arriving on campus is a whirlwind experience for many, and the pressure to succeed in the classroom is made all the more intense if finding funding for the studies themselves remains a crucial task for a new college student. Looking for a new website to peruse student aid options is a great idea, but the best time to do this is always before you take your first steps on campus.

This guide will help you understand the nuances of private loans for your college education so that you can make the best possible decision for your future. Funding options, including private loans, are a must, and resources like TuitionHero.org stand ready to deliver excellent information and assistance to students looking to advance their dreams. Tuition Hero is a new site that’s designed with student needs in mind. With a wealth of information, making the most of your college career is easier than ever. Read on to learn more about adding a private loan to your university funding.

Student loans are in great abundance.

Students are often surprised to find out that there are thousands of options when it comes to adding funding to their university pursuits. From the essential to the obscure, students enjoy a massive range of scholarship, grant, and loan options for their studies. One of the most important things to do when approaching the upcoming college year is to fill out a Free Application for Federal Student Aid (FAFSA) form. The FAFSA is an easy-to-use, digital application for federal student aid. All students are eligible for some form of financial aid, and this is the fastest and simplest way to gain access to this stream of cash for your studies.

Basic federal funding may not cut it, though.

While the federal programs out there offer excellent options for many students, the ecosystem of collegiate tuition ensures that many others will not be able to manage their finances with simple federal aid alone. The relationship between easy access to funding and the tuition that universities charge their students ensures a constantly rising cost of attendance that can leave many students suffering as a result of following their dreams and seeking out a degree and their career aspirations.

With the introduction of a supplementary stream of funding with the help of a private loan, you can gain the financial capital necessary to pursue these dreams to the fullest without having to worry about cash flow problems or feeding yourself between coursework. A private loan is a fantastic resource for students in this way. For many, private loans are approached with the help of a current bank, but loans for education can be gained through a variety of different financial institutions and other lenders. With a resource like Tuition Hero, finding great partners in your continuing success is something that has suddenly become much easier. With an asset like this on your side, finding the resources that you need to drive yourself toward these ultimate goals is simple and no longer excruciatingly time-consuming.

Education is the ultimate resource that a person can wield for enhanced opportunities in life. With additional education and training under your belt, you can confidently apply for new and exciting job opportunities that will advance your life and provide you with a growing wealth of capital and experience throughout your lifetime. Funding these opportunities has always been something that required constant attention and research. Yet, with new and improving resources for linking in with lenders and other opportunities for achieving the financial assistance you need for school, this has become pain-free.